- Home

- Companies

- Memoori Business Intelligence Ltd

- Services

- The Smart Building to Smart Grid ...

The Smart Building to Smart Grid Interface Business 2012

This Report is a Definitive Guide to Assessing the Future of this Fast Growing Business.

- Understand the Size of this Market by product and vertical building type, as well as how the Market will Develop over the next 20 years and the Business Models that will be operated.

- Discover how this Business Opportunity will deliver significant Return on Investment. What will Drive its Future Growth?

Within its 89 pages and over 10 charts and tables, the report delivers key information to industry executives and investors;

- The technology is already in place for both Smart Grid and Smart Buildings to benefit from interfacing and integration. It will not require vast sums of money to bring it about; we estimate approx. 1% of the total Smart Grid investment budget. The likely slowing down of the development of Smart Grid, due to the present poor economic conditions, could serve to enhance the prospects of this business.

- We estimate that in the US, 80,000 sites in the commercial sector offer a high propensity for Smart Building to Smart Grid interfacing. The world population will be over 250,000 buildings.

- In many developed countries Industrial and Commercial Buildings consume 40% of all generated electrical power. Interfacing with this building stock provides large scale opportunities to balance supply and demand particularly as Smart Buildings are already fitted with fully automatic DDC controls.

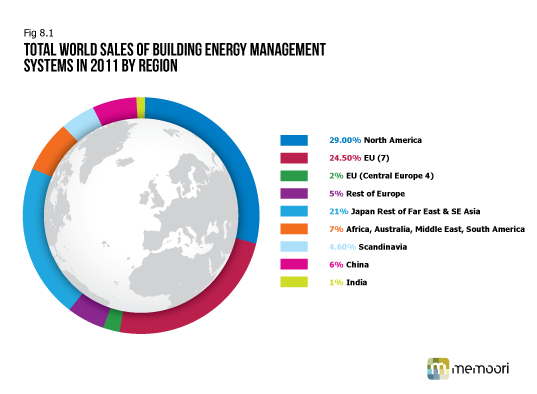

- The size of the world market for Building Energy Management Systems (BEMS); DDC controls that monitor and control environmental plant in commercial and industrial buildings, was $13.39 billion in 2011.

- Current global spend on interface products for Smart Buildings is not likely to be exceeding $100 million. We estimate that the average annual aggregated spend on both the Smart Grid side and Smart Building side for interface software will be approximately $1 billion in 2016 and demand will peak in 2020 at $2.2 billion.

- Sales to the Retrofit Market will account for 65% of this business during the next 5 years. Of this 40% will pass through Specialist IT Integrators. Energy Service Management Companies will take 40% and the balance of 20% will be direct business between the buyer and software supplier.

- Conserving energy through distributed generation coupled with efficient balancing of supply and demand in the Smart building is the most cost effective solution. This must be one of the most attractive businesses to be a part of today for it benefits society, delivers an attractive Return on Investment and has excellent future growth potential.

For only USD $999 this report provides valuable information into how the interfacing and integration of Smart Buildings with Smart Grid will open up major benefits for both the building owners and utility companies.

The information contained in this report will be of value to all those engaged in managing, operating and investing in buildings and smart grid technology around the world – including Building Owners / Operators, Utility Companies, EMSCO’s, BEMS Manufacturers and Energy Providers, In particular those investing in technology such as Distributed Energy, Micro-Grids, Virtual Power Plants and Smart Grid will find it particularly useful.

Preface Executive Summary

- Introduction

- Smart Grid Status & Future Development

- Smart Grid Market Size

- 3.1 Potential Size of Smart Grid World Market by Country

- 3.2 Potential Size of the Smart Grid Market by Product Grouping

- 3.3 Smart Grid Slow Down Will Not Inhibit Interface with Smart Buildings

- Smart Grid Interface with Smart Buildings

- 4.1 Market Size – Consumer Interfaces, HAN, EMS, Storage & EV’s

- Smart Building Development & Vertical Markets

- Smart Buildings – IT Convergence & the Internet of Things

- 6.1 Smart Buildings – IT Convergence

- 6.2 Smart Grid – The Internet of Energy & Other Things

- Smart Buildings Offer Distributed Energy Enhanced Through Virtual Power Plants

- 7.1 The Virtues of Distributed Energy

- 7.2 The Business Model through EMSCO’s

- 7.3 The Major EMSCO Suppliers

- 7.4 The Wider Picture

- Smart Buildings – Market Size of Building Energy Management Systems (BEMS)

- Smart Buildings to Smart Grid Market Size of Interface Systems

- Business Models & Routes to Market

- 10.1 The Development of Business Models

- 10.2 Purchasing Routes to Market

- Market Leaders

- Implementing Strategy through Acquisition

Appendix

- A 1.1 – The World’s Major Smart Grid Companies

List of Charts and Figures

- Fig 3.1 – Smart Grid World Investment at Full Potential ($ Billions)

- Fig 3.2 – World Investment in Smart Grid to Achieve Full Potential by 2030

- Fig 3.3 – Smart Grid Investment Potential by Country & Product Sector at Installed Prices ($ Millions)

- Fig 4.1 – World Smart Grid Sales for Consumer Interfaces 2010 & Forecast to 2030

- Fig 8.1 – Total World Sales of Building Energy Management Systems in 2011 by Region

- Fig 8.2 – Total World Sales of Building Energy Management Systems in 2011 to 2016

- Fig 8.3 – BEMS Market Share by Building Type 2010

- Fig 9.1 – Total World Market Size for Smart Building to Smart Grid Interface Products & Systems 2010 to 2030

- Fig 10.1 – Purchasing Routes of Interface Products 2011

List of Tables

- Table 11.1 – Listing of Suppliers of Smart Building to Smart Grid Interface Products & Systems

- Table A1.1 – The World’s Major Smart Grid Companies