- Home

- Companies

- Unicorn Systems a.s.

- Software

- Lancelot - Version ETRM - 360º Decision ...

Lancelot - Version ETRM -360º Decision Desk for Energy Traders

Optimize trade positions, assess risk exposure and streamline the entire trade life cycle.

A new generation of electricity and gas trading

Legacy and excel-based systems of energy trading are dying. The once notoriously conservative energy industry has become one of innovation, leadership, and possibilities. Energy itself is transforming and so is the technology to support commodity trading.

Lancelot ETRM has been there for energy traders since energy trading began. Surrounded by a complex ecosystem of energy technologies, Lancelot is positioned to deliver a top ETRM solution for all types of energy traders.

360º integration

Integrated workspace for optimal decision making, 360º life cycle management, and market communication.

Pragmatic UX

Built for business, we take a nimble and practical approach to user experience, including lightening speed calculations and on-the-go access from mobile or tablet.

UX features

ETRM as a service

Flexible, fast, and affordable SaaS solution from a trusted energy partner means robust infrastructure and unmatched deployment.

Learn more

An Energy Trade Risk Management (ETRM) system is an integrated workspace for making commercial decisions relating to energy and commodity trading. ETRM systems merge various data inputs, risk exposure analysis and time series calculations with integral trade life cycle processes such as trade capture, scheduling, nomination, confirmation or REMIT. External data inputs essential to calculating position visibility include meteorological data, OTC price reports, economical data and marketplace or trade floor data from operators, partners and other traders. The risk management component of an ETRM system relates to the flexible calculation of credit exposure among trade participants. While position visibility relates to the limitless application of mathematical equations to assess trade opportunities and risk.

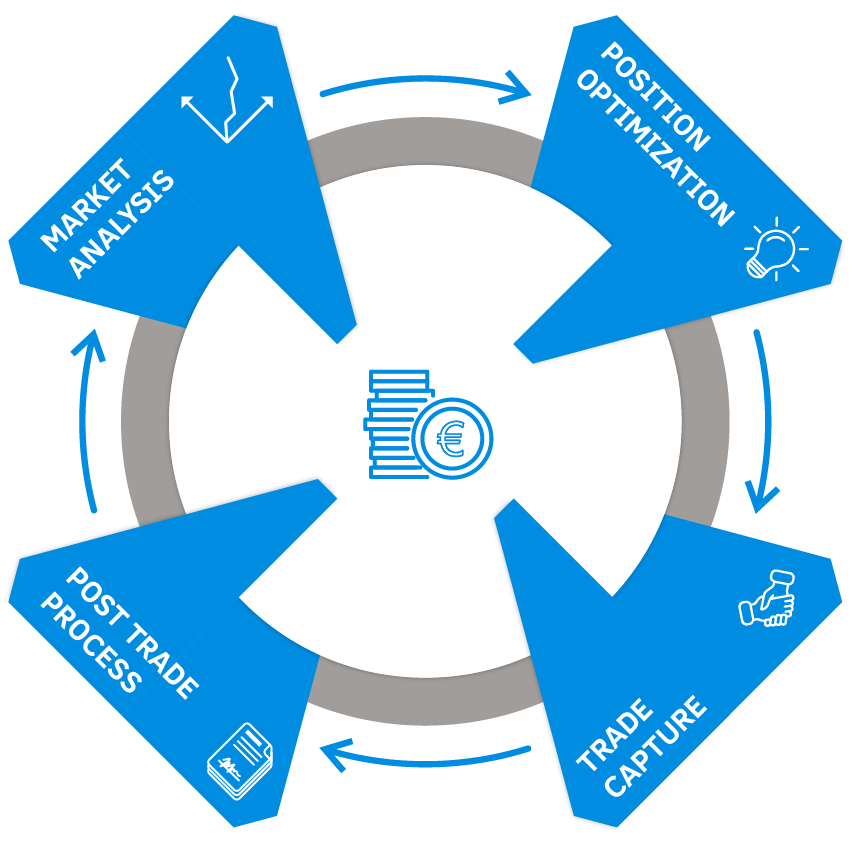

The energy trade life cycle is the business and regulatory process an energy trade must undergo. The most dynamic component of the energy trade life cycle relates to pre-trading activities (position monitoring, risk exposure, opportunity assessment, data analysis) while trade execution and post-trade activities have more structural elements around a regulatory framework (nomination, confirmation, REMIT). As a trade goes through the energy trade life cycle, it touches front, middle, and back offices. Each controller is responsible for their respective parts of the process. Each stage has various activities that sometimes work in tandem and other times require strict sequencing. The ultimate goal of trading energy is to make a profit by striking a beneficial balance between long and short trade assets. What starts as a series of calculations, data analysis, and position assessment, results in a trade among counterparties.

Market analysis

Gain critical insights into market fluctuation and external factors such as weather, socioeconomic elements and supply and demand data to best position trade portfolio.

- Meteorological data

- State and operator data

- Marketplace information

Position optimization

Cover trade positions in the most efficient way by calculating open position metrics and assessing profitable risk exposure.

- Time series calculations

- Forward curve management

- Risk exposure

Trade Capture

Capture your trades from various market places of the following types:

- Commodity (exchanges, brokers...)

- Transmission capacity

- Gas volume of underground storage

- Injection and withdrawal

- Capacity rights at borders

- Emission allowances

- Green certificates (GoO)

Post trade process

Fulfil regulatory and legislative trade aspects. Automation supports reduction of mismatched trades and provides a clear paper trail.

- Nomination

- Confirmation

- Invoicing

- Reporting

- Audit