- Home

- Companies

- Spotfire, by Cloud Software Group, Inc.

- Software

- Spotfire - Risk Management Software

Spotfire - Risk Management Software

Spotfire provides predictive insights to help mitigate risks in valuable resources and assets. It enhances visibility into unknown risks, empowering risk managers to make informed decisions and maintain organizational agility. The software supports real-time event scoring and case management, detecting risky behavior proactively. Spotfire's advanced analytics and machine learning capabilities offer comprehensive risk assessment, transforming data into actionable insights to prevent fraud and manage security concerns. It aids in analyzing potential hazards and implementing safety measures using historical data. Notably, Spotfire facilitates real-time credit card fraud detection, allowing risk analysts to compare transactions and identify potential fraud through batch and real-time data models. The software is also applicable in corporate finance, enhancing decision-making and reducing high-cost risks.

Mitigate risk to your valuable resources and assets with predictive insights

Provide visibility into the unknown, so your risk managers can remain diligent, decide with confidence, and keep your organization agile

Spotfire® allows you to detect and reduce risk by creating more accurate forecasts driven by trusted models. Score events in real time and raise cases for investigation when potentially risky behavior is detected.

Manage risk across the enterprise and deliver actionable insights

Shield your business from fraud

Don’t just react to fraud, prevent it. Expose risk before it happens with Spotfire analytics. With advanced analytics and machine learning, you can capture and consolidate the potential for risk in your data and convert it to insights.

Defend against data breaches

Prevent data breaches and security concerns. Identify, reduce, and act on financial fraud with Spotfire analytics. Streamline your business processes with models that can detect risk before it happens.

Enhancing safety

Reduce the likelihood of harmful events and increase safety across the enterprise. Analyze potential hazards and hazardous conditions with historical data from past accidents to prevent future ones.

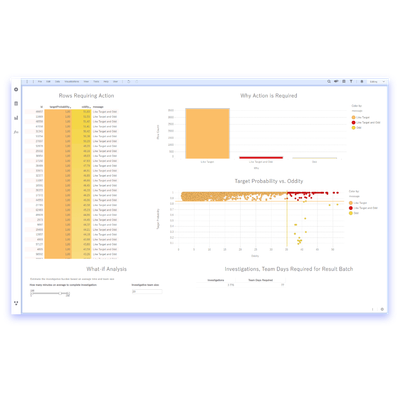

Risk Management with Real-Time Credit Card Fraud Detection

Explore a variety of anomaly and fraud detection scenarios illustrated through a demo for credit card fraud. Risk analysts are able to compare all transactions at once, running models in at-rest batch mode or while also deploying real-time data to identify new transactions as they occur — flagging for potential fraud.