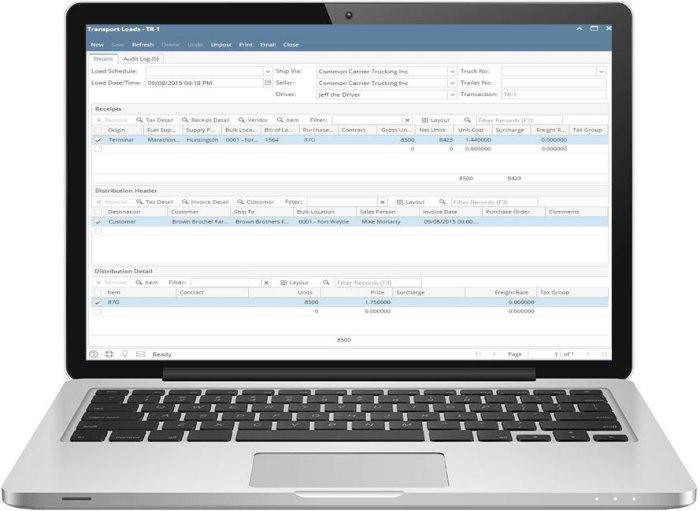

Wholesale Transports Software

Do you spend hours each month digging through mounds of paperwork, combing through spreadsheets and tables, and think, “There’s got to be a better way?” There is. With iRely you can streamline your processes from the moment you get an order to the moment you file taxes. No longer do you need to take multiple steps to generate an invoice, track customer pricing in separate spreadsheets, or spend days each month filing taxes.

Save time with complete integration

For those calculating taxes outside of their accounting and inventory management system, iRely’s incorporated tax reporting system offers the most significant labor savings. iRely can literally do in minutes what now takes days to do by hand. Federal, state, local, sales, and excise taxes are all handled in a simplified process.

Calculate tax in real-time

Tax schedules are stored in the system and exemptions can be noted by customer, by product or class. Whenever relevant transactions are made, tax information is stored and tracked through the system in real-time.

Calculate multi-state taxes with ease

Inbound taxes, outbound taxes, splash-blending, multi-state taxes, and tax exemptions are all accounted for. If you pick up fuel in one state, splash-blend it, and sell it in another state, iRely can quickly sort out how much tax is owed each state and if any exemptions can be applied.

File paper and/or electronic documents

When it comes time to submit your taxes, iRely prints out all the necessary tax documents, and, if your state requires, submits them electronically. That information is then stored so that when audits occur, they can be quickly and easily resolved.

While most transport models keep little or no inventory on-hand, iRely is hard at work on the back end ensuring proper in-truck inventory valuation and making the proper AP and GL entries.

iRely allows you to split loads, disperse to one or more customers, transfer inventory to consigned locations, and disperse remaining fuel to bulk plants. Splash-blends and additives are also easily accounted for.

No matter how you decide to distribute your fuel, iRely remains in-step beside you ensuring that you can account for every gallon and every cent.