- Home

- Companies

- MetaVu, Inc.

- Services

- Environmental Footprint

Environmental Footprint

Environmental footprint measurement, reporting, and analysis is an essential component to understanding the greenhouse gas (GHG) emission and / or environmental impact of your product or service. A thorough understanding the GHG and environmental impact of a product, process, or asset yields valuable insights into the optimum strategies for managing these impacts and associated costs. There may also be revenue implications as eco-labeling proliferates (sustainably harvested wood, chlorine-free paper, biodegradable packaging, etc.).

Well-managed environmental impact correlates to competitive advantage. Once you`ve completed an environmental footprint analysis or greenhouse gas (GHG) inventory, what should you do with it? Anticipated GHG emissions legislation will soon deliver significant economic impacts for those who manage environmental impact and emissions poorly. Strategic and tactical operating and capital investment decisions should be made in part with reasonable assumptions regarding the cost of GHG emissions legislation compliance. Consider your preparedness: will GHG emissions management be a competitve advantage for your company? How will you know?

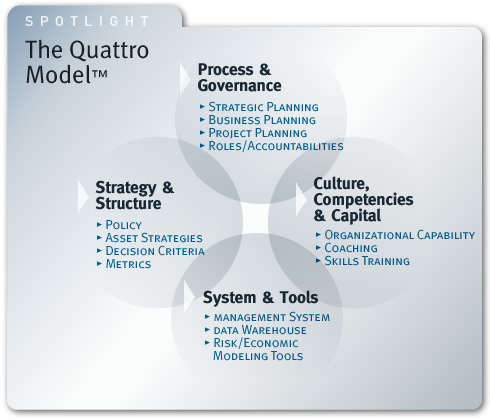

MetaVu`s Quattro Model has been designed specifically to improve organizational capabilities in targeted focus areas. It is particularly valuable when applied to organizations striving to improve their ability to manage the economic impact of anticipated GHG emissions legislation.

MetaVu helps its clients manage environmental impact and GHG emissisons costs in many ways. Metavu’s experience can make a significant contribution to your organization’s current set of environmental investments, as well as help define opportunities and strategies to optimize those investments in the marketplace, in operations, and in making capital investment decisions.

- Greenhouse Gas Baseline Inventory Assessment and Economic Modeling is a cornerstone to understanding and informing your climate change strategy and its integration into a corporate sustainability strategy. Building and maintaining an informed position on your organization’s carbon liability informs capital investment decisions, asset acquisition / divestiture analyses, and optimal positioning of core capabilities.

- Policy, Process, and Decision Support Tools that incorporate the economic impacts of anticipated GHG emissions legislation will be critical to making both strategic and tactical operating and capital investment decisions. How should companies evaluate potential operational changes in light of the price of GHG offsets? How will capital investment choices be modified once the economic impact of GHG offsets are considered? Should companies make investments to reduce their GHG emissions, or buy GHG offsets in the open market? How do these choices change as the market price for GHG offsets changes? MetaVu helps it clients develop the capabilities required to establish GHG emissions management as a competitive advantage.

- Assess Qualification as a Certified Emission Reduction Project for voluntary, early-adopter, participation in the CDM (Clean Development Mechanism), Carbon Disclosure Projects, and to optimally position the organization for compliance under existing and impending regional / federal mandatory GHG assessment and reporting programs.

- Climate Change Strategy and Implementation is essential to operate in today’s markets – domestic and globally. Stakeholders, public media groups, and NGOs are increasingly demanding a greater level of corporate accountability relating to the organization’s relative intensity level of carbon emissions. MetaVu has a broad depth of experience in defining an organization’s climate strategy within the context of an overall sustainability strategy to position for long-term growth and profitability.

- Eco-Labeling provides a valuable means by which organizations may differentiate their products from those of their competitors based on inherent environmental attributes. In MetaVu’s experience, many business units within a single organization have already made considerable capital investments in environmental differentiators, though a return hasn’t been realized on these investments. Oftentimes, the solution is as simple as taking an inventory of existing environmental investments and determining which qualify for eco-labeling opportunities that would communicate their enhanced value to the marketplace.