- Home

- Companies

- MetaVu, Inc.

- Services

- Oil and Gas

Oil and Gas

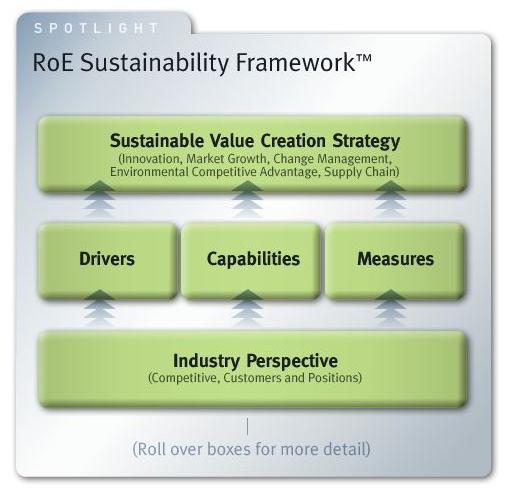

As industry consolidation and climate change policy drive innovation and new technology, oil and gas companies are being pressured to reduce the environmental footprint of their operations, improve social impact and reputation, and use energy and resources more efficiently. How can social and environmental performance improve shareholder value for an oil and gas company?

Benchmarks prove that top quartile Health, Safety and Environmental (HSE) performance contributes to “top line” value creation, which has to do not only with brand premiums and new products, but time to market and even access to markets a company’s social license to operate. Meeting customer environmental and sustainability needs creates opportunities for new products / services / business models, i.e. value creation.

Furthermore, there is a “bottom-line” capital efficiency component to HSE - compliance upgrades and asset life considerations for existing assets and appropriate valuation of carbon, compliance and legacy liabilities and assets for acquisitions. Benefits include:

- Accelerating Through the O&G Value Chain

- Reducing Lease Operating Expense (LOE)

- Driving Early Production via Faster Permitting Cycles

- Increasing Brand / Reputational Capital

- Reducing Energy and Resource Consumption

- Improving Total Shareholder Returns (TSR)

More and more, HSE aspects are being considered in project financing in the capital markets (look at the World Bank – International Finance Corporation guidance and the Equator Principles – a benchmark for the financial industry to manage social and environmental issues in project financing). HSE performance is highly regarded by analysts as an indicator of the overall Quality of Management in assessing the risk of investing in a company.